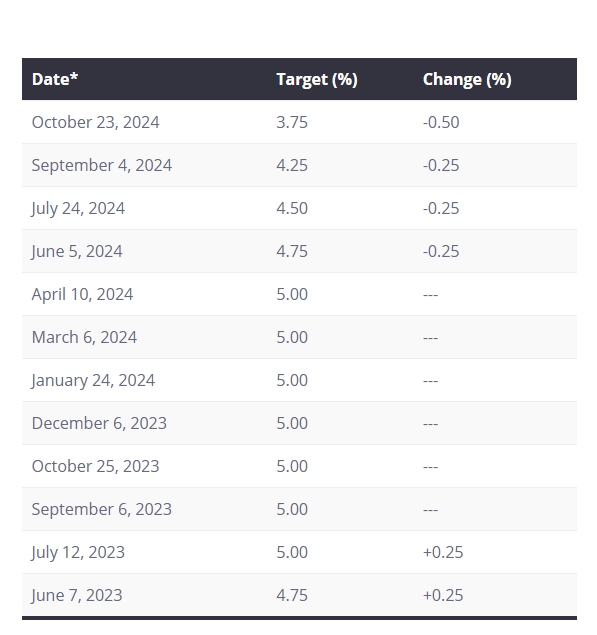

The Bank of Canada (BoC) announced that it will lower its benchmark interest rate by 0.5% on October 23, 2024.

This brings the Canadian benchmark rate to 3.75%. The Bank of Canada has been steadily lowering the rate by 0.25% for the last three meetings.

The big cut in the US (0.5% cut) seems to have widened the consensus for a rate cut, leading to a 0.5% big cut.

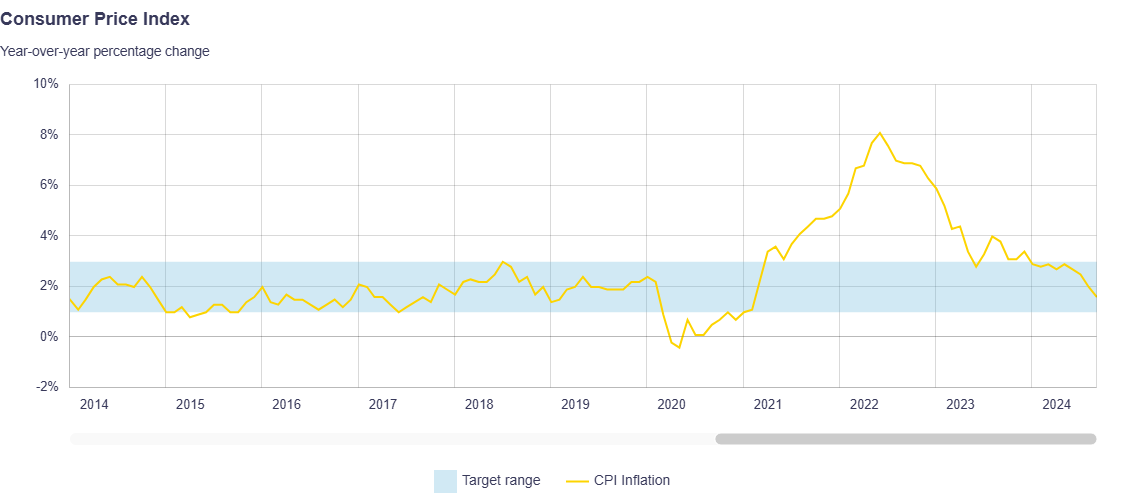

Consumer price index (CPI) inflation, which is said to be a necessary condition for the rate cut, has been stable at 1.6% in September, down from 2.7% in June.

The labor market remains strong with an unemployment rate of 6.5% as of September, and Canadian growth is expected to be 2% in the first half of the year and 1.75% in the second half of the year.

The BoC describes the move as a reflection of the economy’s state of affairs, aimed at boosting the labor market and declining growth rates.

The last rate change policy decision of the year is scheduled for December 11, with a discussion of additional interest rates to follow on January 29 of next year.