Canada’s central bank cuts policy rate by 50 basis points to 3.25 percent

The Bank of Canada cut its policy rate by 50 basis points (bp) on December 12, 2024, bringing the benchmark interest rate to 3.25%.

This was the fifth consecutive rate cut since June, as the Canadian economy grew by just 1% in the third quarter,

and the cut was larger than the 25-point cut expected by experts, as employment data came in weak.

Inflation is stabilizing at around 2%, but short-term fluctuations are expected due to temporary factors such as the GST (Goods and Services Tax) exemption.

The central bank is maintaining a cautious approach to rate cuts, closely monitoring risks such as wage pressures and potential US trade tariffs.

The central bank believes that the rate cuts are having a positive impact in supporting household spending.

Given the various external factors affecting Canada, such as the increase in U.S. tariffs, it remains to be seen if the rate cut will be able to stimulate economic growth, employment, and the

real estate market.

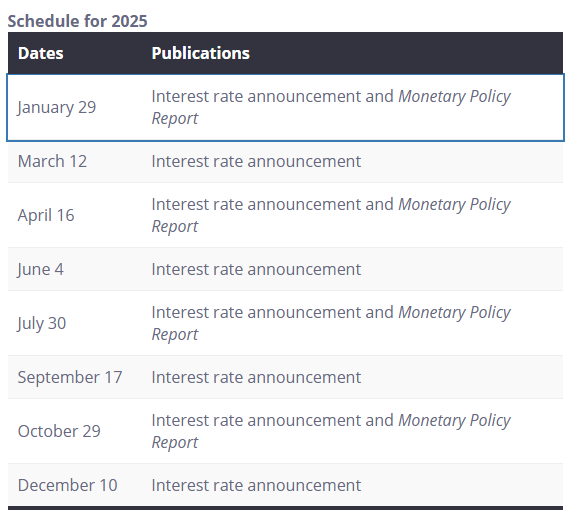

This concludes the last rate policy for the year, with the next rate policy decision scheduled for January 29, 2025.