Will a 25-basis-point cut in Canada’s benchmark interest rate boost Vancouver’s sales market? (20240605)

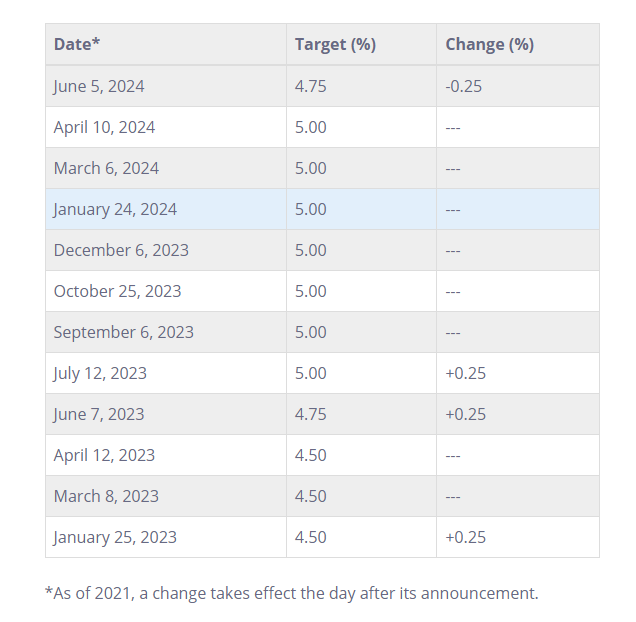

On June 5, 2024, the Bank of Canada cut the Canadian benchmark interest rate by 25 basis points, bringing the Canadian benchmark rate down to 4.75% from 5%.

The decision comes 11 months after the central bank recently raised its benchmark interest rate to 5 percent on inflation concerns.

Market participants are interested to see if this will boost the Vancouver real estate market and the Vancouver sales market.

For reference, the U.S., which is an important indicator in determining interest rates, continues to keep its benchmark rate unchanged.

We expect one rate cut this year, but it remains to be seen.

In the U.S., inflation is still not fully contained and economic growth is strong, so many believe that there are not enough factors to warrant a rate cut.

In Canada, on the other hand, the Bank of Canada seems to have decided that inflation concerns are a bit less of a concern, with the inflation rate recently coming down to the 2% range, and the recent signs of a slowdown in the Canadian economy are also likely behind the decision to cut rates.

However, there are questions about how much and for how long the interest rate differential with the US can be maintained. One thing to watch out for is the direction of whether they will continue to lower rates going forward, as some believe that it will be difficult to see the Canadian benchmark rate going down quickly while there are still concerns about inflation. The Bank of Canada has also said that it will keep a close eye on inflation when making decisions about the benchmark rate.

Regardless, the Bank of Canada’s latest rate cut seems to have given real estate participants and the Vancouver sales market hope that the Canadian real estate market will be revitalized.

In addition, buyers who have previously purchased a home with a mortgage at a lower rate have been feeling the pressure as they approach renewal time, and the lowering of the Canadian benchmark interest rate has eased some of that pressure.

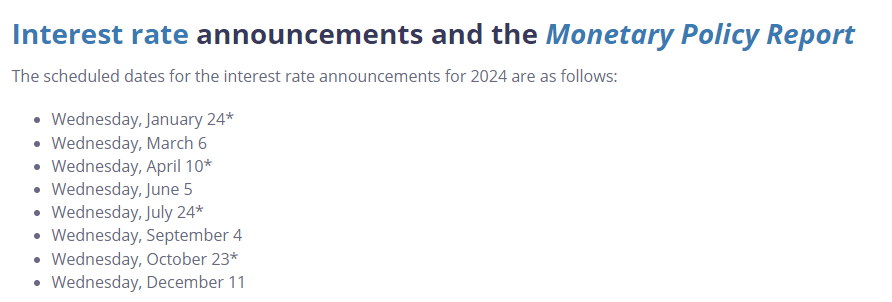

For reference, the Bank of Canada meets eight times a year to discuss the benchmark interest rate, with the next rate announcement scheduled for July 24, 2024.