The Greater Vancouver real estate market experienced a mixed February 2025, marked by increased sales activity compared to January but showing signs of caution compared to previous years. With shifting government incentives, economic uncertainty, and slowing immigration growth, the presale market faces an inflection point. This article breaks down the key trends, policy influences, and investment opportunities shaping the market.

Market Overview: February 2025 in Numbers

1. Sales Performance

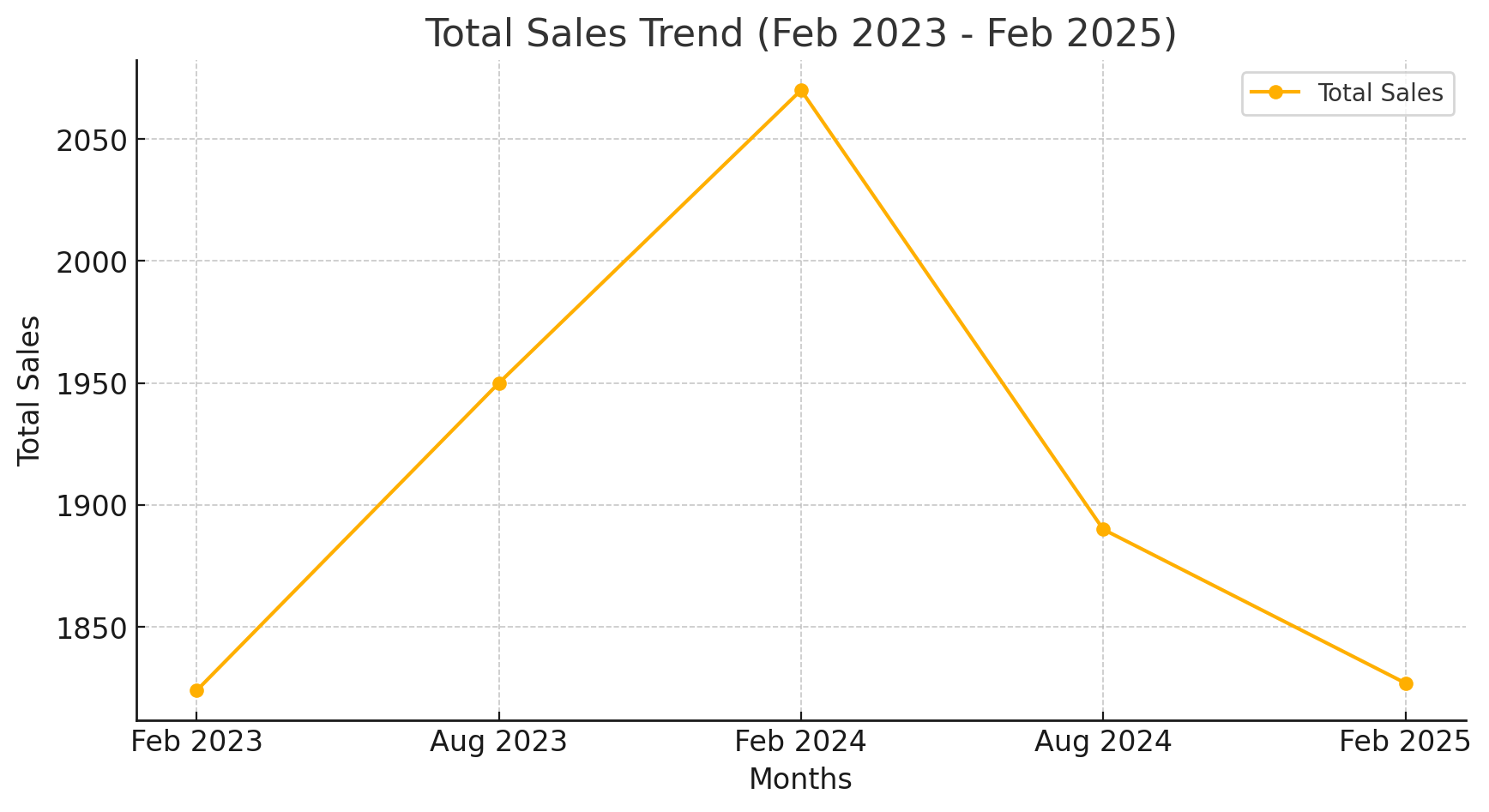

- 1,827 properties sold, a 17.7% increase from January but 11% lower than February 2024.

- Sales were nearly identical to February 2023’s 1,824 transactions, showing a stabilization of market activity.

- Sales breakdown:

- Detached homes: 477

- Apartments: 976

- Attached homes: 359

2. Listings & Supply

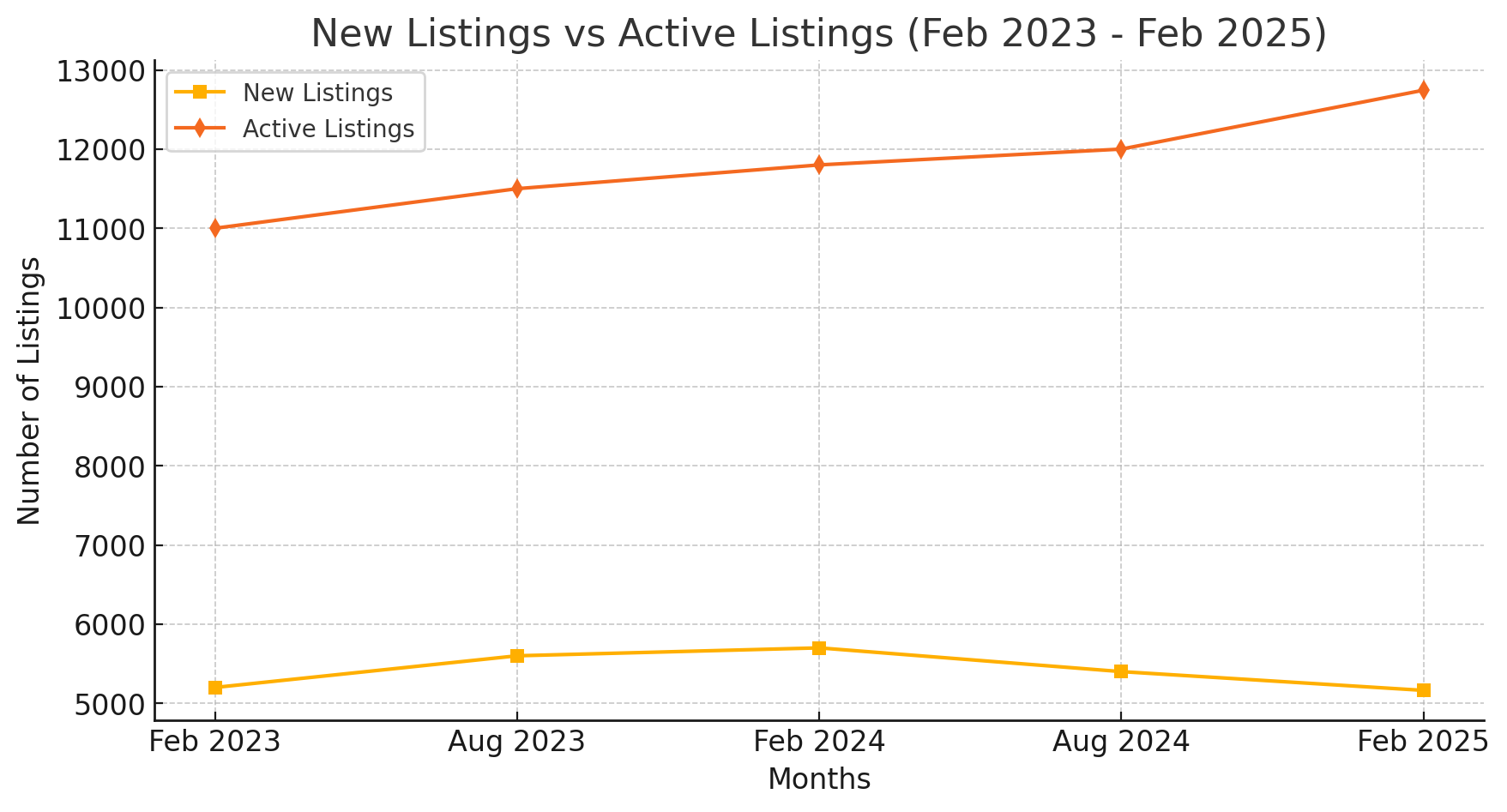

- 5,163 new listings entered the market, down from January’s 5,644, suggesting sellers are adopting a wait-and-see approach.

- Total active listings reached 12,744, a slight increase from 11,494 in January.

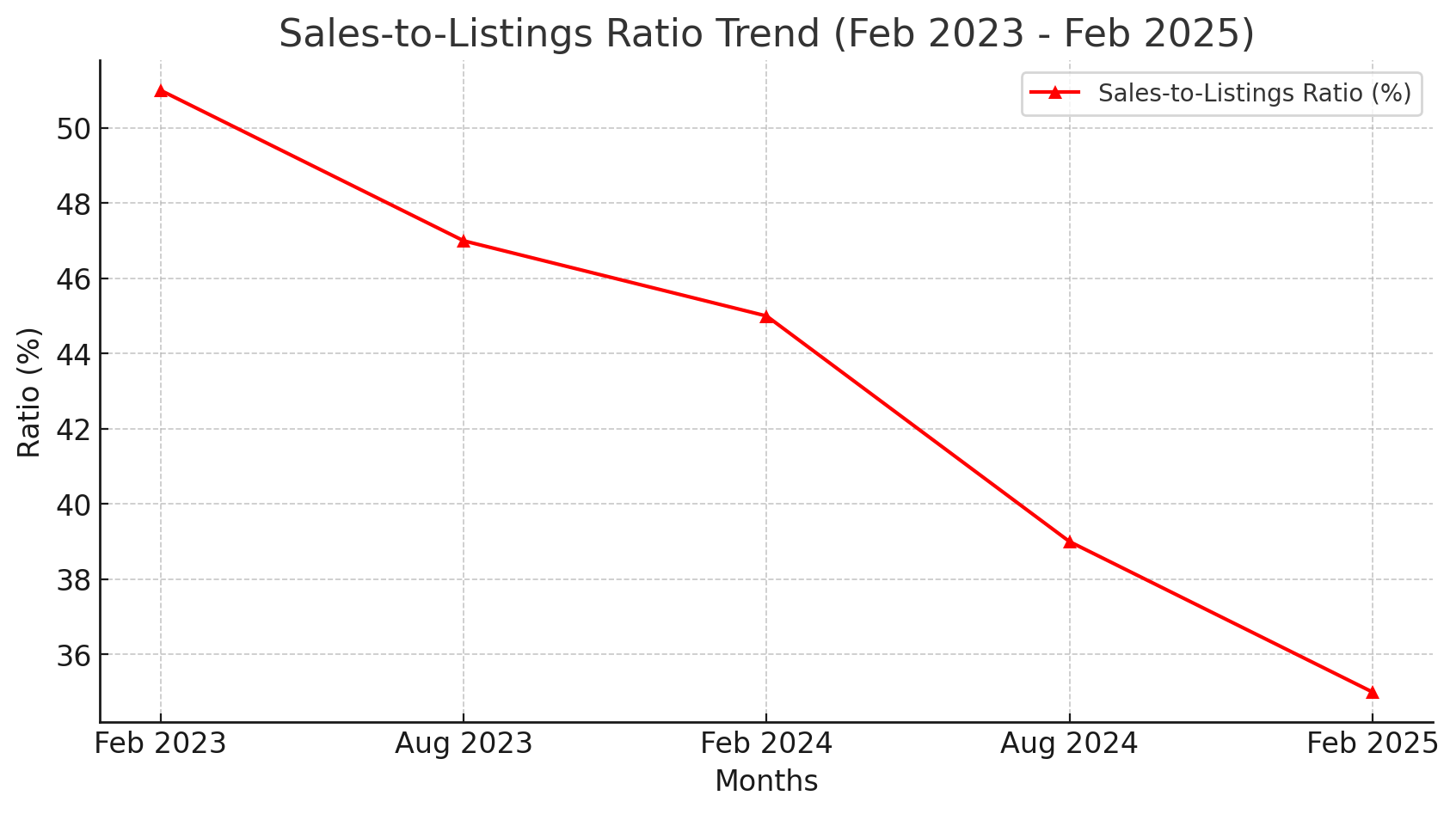

- The sales-to-listings ratio climbed to 35%, signaling a shift toward a more balanced market, although it remains below February 2024’s 45% ratio.

3. Months of Supply

- Months of Supply is calculated as (Active Listings / Monthly Sales)

- A balanced market (where neither buyers nor sellers have a strong advantage) typically has 4-6 months of supply.

- A buyer’s market (where buyers have more negotiating power and prices may decline) has more than 6 months of supply.

- A seller’s market (where competition drives prices up) has less than 4 months of supply.

- Overall supply in February 2025 remained at 7 months, with townhomes maintaining the most competitive market conditions:

- Detached homes: 9 months (down from 11 in January)

- Townhomes: 5 months (unchanged)

- Condos: 6 months (unchanged)

Key Factors Shaping the Market

1. Cancellation of B.C.’s Secondary Suite Incentive Program

In a surprising policy shift, the B.C. government announced it would cancel the Secondary Suite Incentive Program by March 31, 2025, citing financial uncertainty and a forthcoming federal program.

🔸 Impact on Investors & Presale Demand:

- With fewer homeowners financially supported to build rental suites, some investors may shift toward presale condos instead of secondary suite conversions.

- Fewer secondary suites mean reduced rental supply, which could increase rents and demand for investor-owned presale condos.

However, the federal loan program—which promises up to $80,000 in low-interest loans—could reverse this trend if it proves accessible and effective, potentially redirecting investment back to single-family homes with rental units.

2. Slowing Immigration & Its Effect on Demand

A crucial factor influencing the real estate market is Canada’s slowing immigration growth.

📉 Key Statistics:

- Canada’s population growth slowed to 1.8% in 2024, down from 3.1% in 2023 and 2.5% in 2022.

- A total of 744,324 new residents were added, bringing Canada’s population to 41.5 million.

- International migration remains the primary driver of growth, but policy shifts and economic concerns could further slow down immigration rates.

🔸 How This Affects the Presale Market

- Vancouver’s rental market heavily depends on immigration—fewer newcomers could mean lower rental demand, impacting investor confidence in presale condos.

- However, if the government reverses its stricter immigration policies, demand could quickly rebound, fueling presale activity again.

3. Developer Activity & Presale Market Trends

🔸 Presale Investor Considerations:

- With fewer secondary suites expected, demand for rental units in new condo projects may rise.

- Developers may adjust marketing strategies to attract investors by offering rental guarantees or buyer incentives.

- If economic conditions stabilize and interest rates decline, presale activity could see a stronger second half of 2025.

What’s Next? Market Outlook for 2025

With B.C.’s policy shifts, slowing immigration, and global economic uncertainty, Vancouver’s presale market is entering a period of recalibration.

📊 Key Watch Areas:

✅ Federal Secondary Suite Loan Program: If widely adopted, it may shift investor interest back to single-family properties.

✅ Bank of Canada Rate Decisions: Interest rate adjustments will influence presale affordability and buyer sentiment.

✅ Immigration Policies: If growth remains slow, rental demand may weaken, but if policies loosen, housing demand could accelerate again.

For short-term investors, the tightening rental market could boost rental yields on presale condos. However, those with a long-term horizon should keep a close eye on immigration and policy shifts, as they will shape Vancouver’s real estate demand in the coming years.

Want to Explore More?

📊 Check out the full February 2025 Greater Vancouver Realty Report:

📺 Watch the video summary